Feb 20, 2018

This article was originally published in Kates Boylston Publications Funeral Director’s Guide to Statistics (2017 issue) by our Staff Writer, Jessica Farren (Fowler). This latest edition features the most up-to-date statistical information in the industry, and provides you with tools and knowledge to better understand buying trends, what services families want most and more. Click here to learn more or to order your copy of the Funeral Director’s Guide to Statistics.

There are two fundamental questions every funeral home’s

marketing strategy should address. The first, and most obvious is

how do we get the phone to ring? Or, to

be more specific, how do we persuade families in our area to contact our

funeral home in their time of need? The second question, although equally

important, is often overlooked when funeral homes analyze their marketing

efforts.

How do we ensure that every

call, without exception, is answered promptly and handled properly?

With so much emphasis placed on attracting

interest, funeral professionals must be careful not to forget how communication

can impact their funeral home’s reputation and growth.

This survey

examines the synergistic relationship between funeral home marketing and

communication. Overall, more than 1,700 funeral professionals responded to the

survey.

Participants were asked to

answer questions about the strategies they have used to grow their funeral

home’s market share, communication challenges they have experienced and mobile

technology preferences. The survey also studies the impact of shopper

calls on funeral home marketing and communication.

The survey was

conducted by ASD – Answering Service for Directors, the leading funeral home

answering service, and was sent by means of a questionnaire using the internet

survey tool Survey Monkey. In an effort to construct a thorough analysis of the

marketing and communication behaviors of funeral professionals, ASD polled both

its current client base as well as funeral professionals who do not use the

company’s services.

About

Survey Participants

Current Position

The survey drew responses from 1,791 funeral professionals: About

37 percent (659) were full-time licensed funeral directors, 18 percent (321)

were sole owners, 16 percent (282) were co-owners, 11 percent (211) were

managers, 3 percent (57) were apprentices, 3 percent (52) were part-time

licensed funeral directors, 2 percent (45) were office receptionists, 2 percent

(28) were family counselors and 2 percent (27) were funeral attendants. About 6

percent (109) selected ‘other’ and listed a different position such as

crematory operator, embalmer or event director.

Location

The survey was sent out to funeral homes located in all 50

states. About 46 percent (817) of the funeral

professionals polled serve families in a suburban area, 33 percent (595) serve

families in a rural area, and 21 percent (379) serve families in an urban area.

First Calls Handled Per Year

About 75 percent of funeral professionals surveyed handle

more than 100 cases per year. More than a third handle over 300 cases a year.

Below is a breakdown of this data.

|

First Calls Handled/ |

% of Respondents |

Number of |

|

0-50 |

7 percent |

126 |

|

50-100 |

17 percent |

302 |

|

100-299 |

44 percent |

786 |

|

300-499 |

16 percent |

291 |

|

More than 500 |

16 percent |

286 |

Marketing and Growth Trends

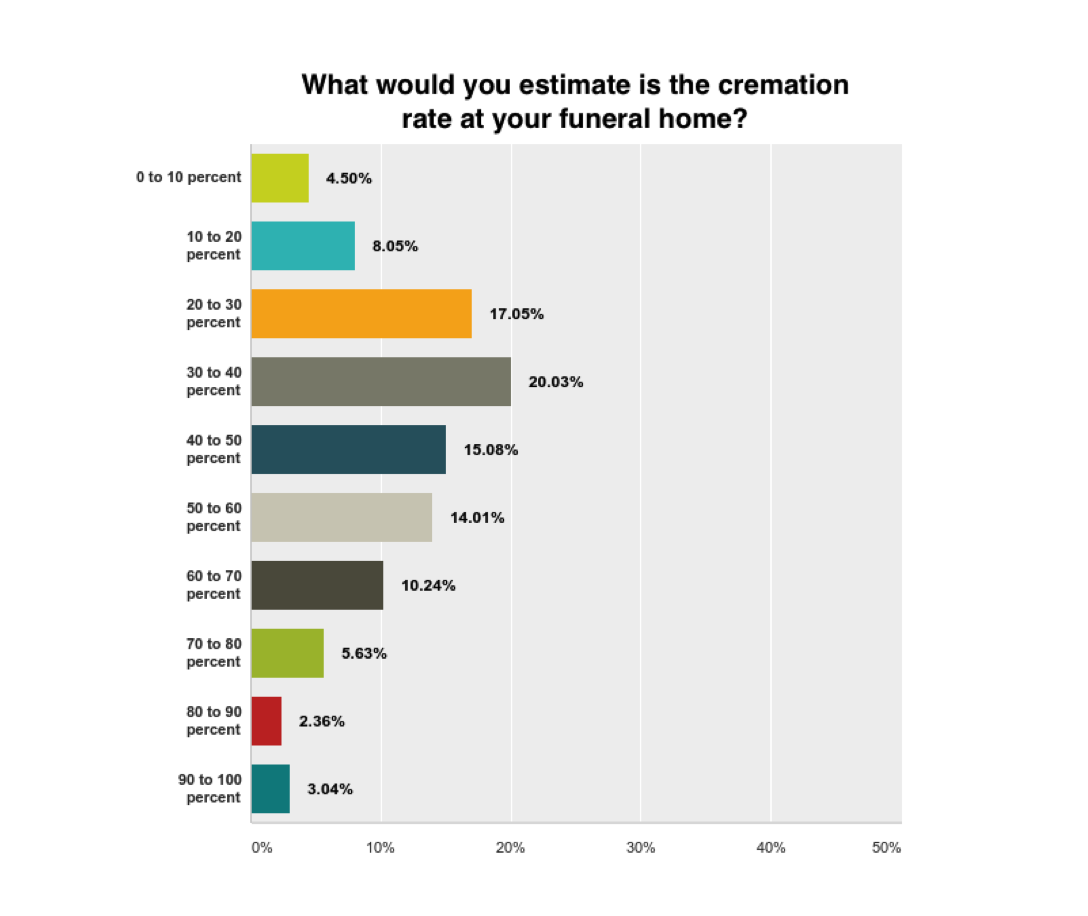

Cremation Rate

Slightly more than half of the funeral professionals polled

(898) have a cremation rate over 40 percent. Below is a full breakdown of this

data.

Market Share Growth

Participants were asked how much attention is given to

growing their funeral home’s market share. Nearly half of the respondents (41 percent)

answered that a ‘tremendous amount’ or ‘a lot’ of time was given to growing the

funeral home business. A nearly equal number (39 percent) of participants

selected ‘a reasonable amount’. About 20 percent answered that very little or

no time at all is spent growing their funeral home’s market share. These

results suggest that while most funeral professionals want to achieve a

competitive advantage, a surprisingly high number do not have the time or

resources to focus on growth. It is also possible a portion of the funeral professionals

interviewed may be less focused on increasing their market share because they

feel they have already achieved this objective.

Marketing Methods

The survey asked funeral professionals to indicate what

materials their funeral home uses to market the business and achieve goals. Below

is a breakdown of the most commonly utilized marketing materials listed by

survey participants.

- 60 percent use promotional brochures and pamphlets

- 55 percent send surveys to families served in the past

- 41 percent have a defined business plan

- 38 percent have a defined marketing plan

- 32 percent use website lead conversion tracking

- 21 percent use phone call conversion tracking

- 19 percent send newsletters or bulletins to families served

in the past.

This data reveals how marketing can often take a backseat to

other business matters within a funeral home. While more than half of those

surveyed have implemented at least one type of marketing initiative in the

past, these statistics suggest a lack of consistency and follow through may

hinder results. Less than half of survey respondents utilize a business or

marketing plan when implementing different strategies. These statistics

indicate that many of the marketing efforts used by funeral homes may be

executed without a focus on long-term goals. The old mantra,

‘throw it against the wall and see what

sticks’

seems to be governing these decisions, leading many to adopt a

trial-and-error based approach. Without such a business or marketing plan in

place, funeral directors may begin to see marketing efforts as fruitless

because they have not created metrics for tracking results.

Another example of this lack of focus was revealed by asking

funeral professionals how they market to families they have previously served.

While more than half (55 percent) send out surveys to families they have served

in the past, only 19 percent send newsletters or bulletins. The data reveals a

surprisingly high number of outreach opportunities are being missed by funeral

homes. Newsletters and bulletins allow funeral homes to expand their aftercare

programs and help their community to view them as a resource. While it is

certainly helpful to gather feedback from families, it is just as important, if

not more so, to maintain these relationships and demonstrate your funeral

home’s ongoing support. These two marketing goals should be closely aligned,

yet more than 80 percent of funeral professionals surveyed did not make this

connection.

ASD also asked survey participants if they currently

utilized a marketing company to promote their services. Less than half (48

percent) are currently using a marketing company. This number reveals many of

the funeral homes that have created marketing materials and strategies have

done so with little to no guidance.

Communication Trends and Challenges

Shopper Calls

Participants

were asked what percentage of their funeral home’s new business they estimate

comes from shopper calls. For clarification purposes, the term ‘shopper’ was

defined within the survey as any

person who is contacting a funeral home they have no prior experience with to

gather information on services, options and/or pricing. About 60 percent of

funeral professionals polled attribute between 10 and 40 percent of their new

business to shopper calls. More than a third (36 percent) of respondents

attribute over 20 percent of their new business to shopper calls. Below is a

full breakdown of this data:

|

Percentage of new business obtained through shopper calls |

Percentage of Respondents |

|

Less than 10 percent |

31 percent |

|

10 to 20 percent |

33 percent |

|

20 to 30 percent |

19 percent |

|

30 to 40 percent |

8 percent |

|

More than 40 percent |

9 percent |

Average Duration of

Shopper Calls

How

much time do funeral professionals typically spend answering questions from

shoppers? The majority of survey respondents (38 percent) answered that the

average duration of these calls is 5 to 10 minutes. Only one quarter of

survey respondents spend more than 10 minutes on average when handling shopper

calls. Below is a full breakdown of this data.

|

Shopper Call Duration |

Percentage of Respondents |

|

Less than 2 minutes |

3 percent |

|

2-5 minutes |

34 percent |

|

5-10 minutes |

38 percent |

|

10-15 minutes |

17 percent |

|

15-25 minutes |

6 percent |

|

More than 25 minutes |

2 percent |

Telecommunication Disruption

ASD asked participants what telecommunication problems their

funeral home has experienced in the past 12 months. Below is a breakdown of the

most common disruption issues that affect funeral professionals:

- 19 percent have experienced a power outage

- 13 percent have experienced call forwarding

issues - 12 percent have had miscommunication issues

arise between on-call employees. - 6 percent have had issues with missing urgent

calls - 4 percent have had issues with crossed telephone

lines - 4 percent have experienced ‘Other’ issues

including problems with their phone system or company (36 percent), Internet

issues (26 percent), issues with solicitation calls (20 percent), answering

service issues (13 percent), or cell phone issues (5 percent).

Cellular

service problems were the most common issue reported, which is consistent with

national statistics. According to Pew Research, 72 percent of cell phone owners

in America have experienced dropped calls occasionally, while 32 percent say

they experience this problem on a weekly basis. Mobile reliability statistics

vary greatly by region, with consumers in urban areas experiencing the highest

number of overall network problems (J.D. Power).

The second

most common issue reported was power outages. This is a widespread issue that

has increased in recent years, with the U.S. Department of Energy data showing

that the number of reported power outages in the country rose steadily between

2000 and 2014, with the annual average of outages doubling every five years. In

fact, The United States endures more blackouts

than any other developed nation. According to Inside Energy, “An aging infrastructure, combined with a

growing population and more frequent extreme weather, are straining the

electric grid.”

With

VoIP technology now replacing traditional telephone lines in many funeral

homes, only 13 percent of the funeral professionals surveyed have experienced

issues with call forwarding. While there is very little data to be found on how

call forwarding has evolved on a national level, a recent Software Advice study

from 2015 found that buyers view call forwarding as the most critical PBS

functionality, ranked 4 percent higher than Voicemail. Of the funeral

professionals surveyed, 66 percent are currently call forwarding to an

answering service. Less than 3 percent are currently experiencing disruption

issues with their answering service. Of those who are currently using a

service, 88 percent are satisfied with their current provider.

Communication Challenges

Participants were asked to identify the key communication

challenges facing their business. Below is a breakdown of this data:

- 75 percent: Growing the business/Attracting more

customers/Increasing demand - 39 percent: Improving staff skills and knowledge

- 25 percent: Monitoring customer satisfaction

- 22 percent: Improving internal processes and

procedures - 17 percent: Improving management and IT systems

- 14 percent: Changing business directions,

services, product lines or operational systems - 8 percent: Establishing and improving

relationships with suppliers and trading partners

Three out of every four people surveyed felt that growing

their funeral home was a crucial communication challenge facing their business.

Considering the fact that less than half of the survey participants actually

own a portion of their funeral home, these numbers demonstrate how increasing

demand for services is a major focus for every person working at a funeral

home, not just owners.

It is interesting to note that while the majority of the

funeral professionals polled recognize business growth as the most important

challenge, most funeral homes (52 percent) do not use a marketing company and about

15 percent do not use any marketing materials. This indicates many funeral

homes are unwilling or unable to invest in marketing despite recognizing the

challenges of attracting new families.

Another interesting finding is the percentage of funeral

professionals who identified internal communication as a key challenge faced by

their business. More than half (61 percent) were concerned with improving staff

skills/knowledge, improving internal processes/procedures or both. While

growing the business is priority one, many also find it challenging to keep

their staff working cohesively and efficiently.

Training Communication

Funeral professionals surveyed were asked how much training

their funeral home provides to staff on telephone etiquette. Responses were split almost right down the

middle with nearly half of respondents (41 percent) answering that a

‘reasonable amount’ of training was provided to staff. A third answered that a

‘tremendous amount’ or ‘a lot’ of telephone training was offered to their

staff, while a nearly equal number (29 percent) answered that ‘very little’ or

‘no training at all’ was provided.

Survey participants were asked about their firm’s

documentation process for training materials. About 42 percent have documented

operational policies, processes and procedures in their funeral home. Nearly a third (29 percent) have instructional

guides and training manuals for their staff.

Recommendations

Survey participants were asked several optional questions

about their current satisfaction with communication and marketing service

providers.

Cell Phone Company

Of the 1471 survey participants who responded, 91 percent

were satisfied with their current cell phone company.

306 survey participants provided recommendation feedback:

- Verizon Wireless: 68

percent - AT&T: 16

percent - U.S. Cellular: 6

percent - Sprint: 5 percent

- T-Mobile: 2

percent - Other (Metro PCS,

Bell, Telus, Cricket, Charter, etc):

3 percent.

Marketing Company

Of the 1471 survey participants who responded, about 45

percent were satisfied with their current marketing company, 52 percent did not

use a marketing company, and 3 percent were dissatisfied.

54 survey participants provided recommendation feedback:

- MKJ Marketing: 21

percent - Precoa: 17

percent - Adfinity: 15

percent - CGI: 6 percent

- Disrupt Media: 3

percent - Other (Leap Tie,

Thanexus, Crest Communications, local companies, etc):

38 percent

Mobile Apps

204 survey participants provided recommendation feedback on

mobile apps. About 73 percent of apps recommended were created specifically for

funeral homes while 27 percent were general business apps.

Top Funeral

Specific Apps

- ASD Mobile: Allows

clients of ASD – Answering Service for Directors to access and respond to

messages, track calls, disguise their outgoing cell phone Caller ID and more. (52

percent) - Find A Grave:

Powered by Ancestry.com, this app offers a database of more than 100 million

graves in half a million cemeteries around the world. (8 percent) - Vital ICE: A

public safety app that stores user medical information and emergency contacts. Many

funeral homes have sponsored their community’s Vital ICE as a way to give back

to their local area by providing a life-saving app to residents for no cost. (4

percent) - Everdays:

Everdays helps you notify family and friends when a loved one passes,

eliminating the need for multiple phone calls, text messages or emails. (2

percent) - Embalm Calc: This

newer app helps embalmers mix embalming fluids correctly by performing fluid

calculations. (2 percent) - Other Funeral

Specific Apps (FloralXpress, SRS Computing, Passare, Legacy Touch, etc)

(5

percent)

Top General

Business Apps

- Dropbox: This

popular cloud-storage app allows users to share documents between devices,

upload photos, email large files, and collaborate on projects with their team.

(16 percent) - Waze: A great app

to help drivers avoid traffic jams, Waze uses crowd-sourced alerts from real

drivers, providing users with real-time information on traffic flow and what

areas to avoid.

(5 percent) - Flight Aware: This free flight tracker and flight status

app allows users to track airline flights in real-time.

(2 percent) - Other Business Apps

(Trello, Red Booth, Poynt, TurboScan, etc):

(4 percent)

Comments made about mobile apps by

survey respondents:

“ASD Mobile. Great to

have the call right there and to know there is a first call up to 10 minutes

before the “call” is live, plus the ability to go back to track calls

as well.”

“Dropbox is excellent.

With this app, we can access and send copies of our General Price List, casket

selections, and items such as readings for funeral mass, prayer card selections.

It makes it so easy to help those who are making arrangements out of state.”

“Vital Ice. We made

this app available to our entire community for free download to assist our local

first responders.”

Kates Boylston Publications, January 2018

Are you surprised by any of the findings of ASD’s Communications? Leave us a comment – we’d love to hear your thoughts on our survey results!

About The Author

Jess Farren (Fowler)

Jess Farren (Fowler) is a Public Relations Specialist and Staff Writer who has been a part of the ASD team since 2003. Jess manages ASD’s company blog and has been published in several funeral trade magazines. She has written articles on a variety of subjects including communication, business planning, technology, marketing and funeral trends. You can contact Jess directly at Jess@myASD.com